ルイヴィトン ×NIGO ポルトフォイユ ミュルティプル 財布 レア

(税込) 送料込み

商品の説明

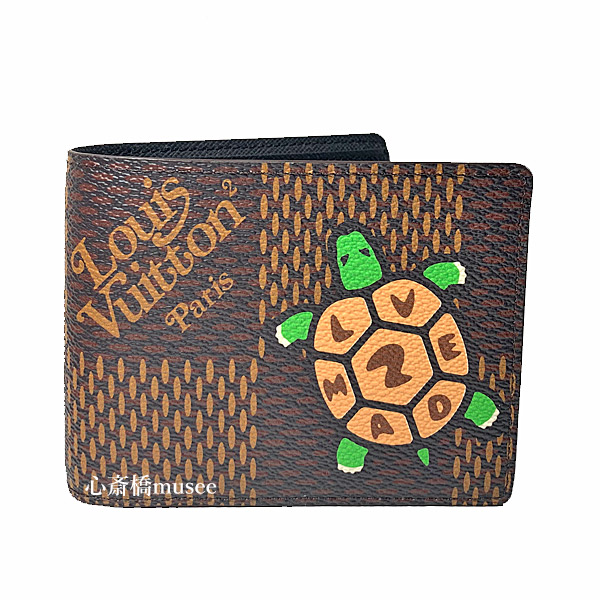

Apeの創設者であり現在human madeの NIGO氏と

故ヴァージル アブロー氏のコラボシリーズ

LV² スクエアードコレクションの第1段

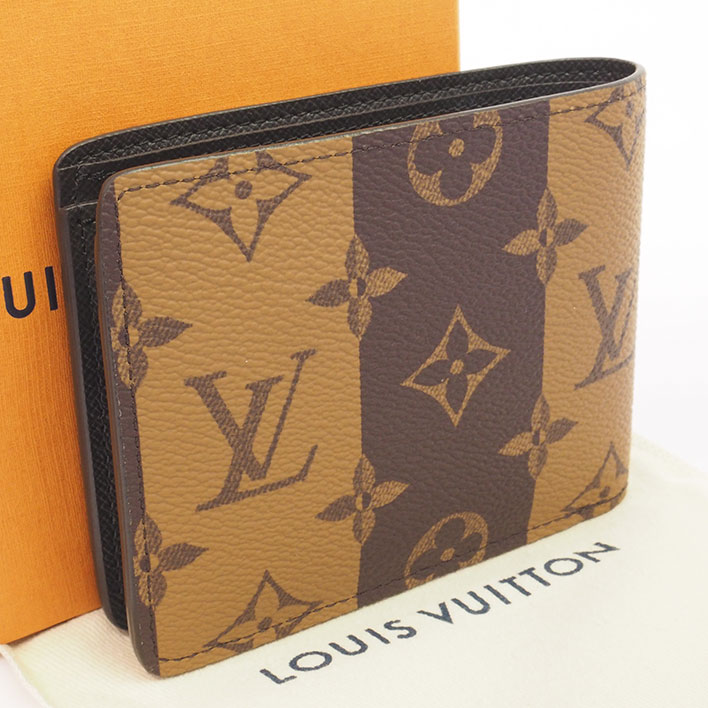

二つ折財布の定番ポルトフォイユ・ミュルティプルに

NIGO氏が描いたカメを大胆に落とし込んだ

大人気の限定品となっております

○ブランド

LOUIS VUITTON ルイヴィトン

○ライン

LV² コレクション スクエアードコレクション

○素材

ダミエ・エベヌ ジャイアント キャンバス

○サイズ

縦約9cm

横約11.5cm

マチ約1.5cm

○ポケット

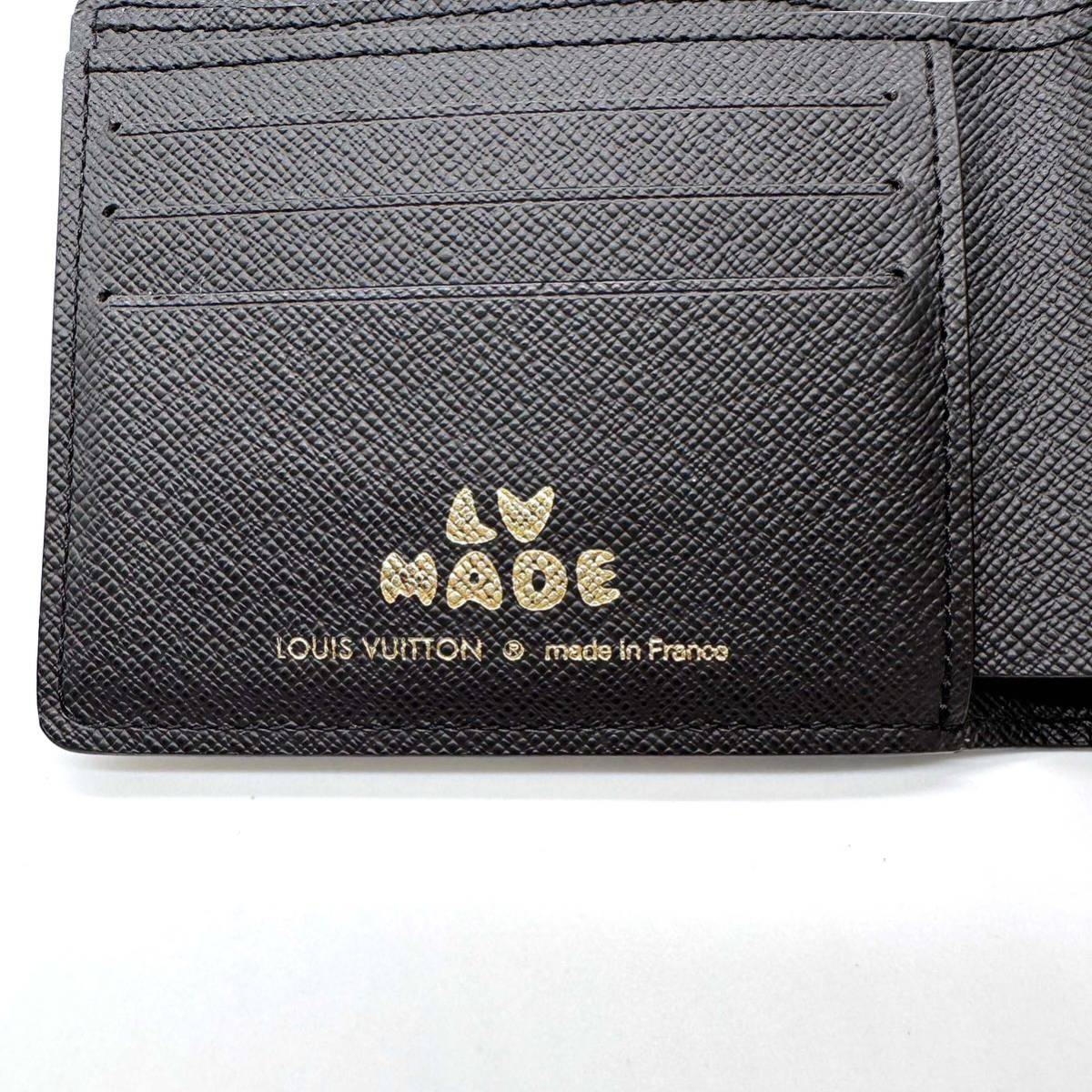

内側・カードポケット×3

紙幣やチケットを収納可能なコンパートメントx2

レシート用サイドポケットx2

名刺用ポケットx2

正規品になります。

購入店舗:ルイヴィトン西梅田店

シリアルナンバー:RA4230

自宅保管になりますので、3枚目以降のような不備がございます。ご了承いただける方のみのご購入お願いいたします。

レシート、箱等はございません。ご了承くださいませ。商品の情報

| カテゴリー | メンズ > 小物 > 折り財布 |

|---|---|

| ブランド | ルイヴィトン |

| 商品の色を | ブラック系 / オレンジ系 / イエロー系 |

| 商品の状態 | 目立った傷や汚れなし |

ルイヴィトン × NIGO ポルトフォイユ・ミュルティプル 折りたたみ財布

nigo ルイヴィトン ポルトフォイユ・ミュルティプル 【公式】 www

ルイヴィトン ポルトフォイユ ミュルティプル NIGO 折り財布 M81108-

ルイヴィトン ポルトフォイユ ミュルティプル NIGO 折り財布 M81108-

ルイヴィトン ×NIGO 折り財布-

2023年最新】nigo louis vuitton 財布の人気アイテム - メルカリ

ポルトフォイユ ミュルティプル 二つ折り財布 ダミエジャイアント

ルイヴィトン ×NIGO ポルトフォイユ ミュルティプル 財布 レア 公式

ルイヴィトン ポルトフォイユ ミュルティプル NIGO 折り財布 M81108-

公式ストア LOUIS VUITTON NIGO 折り畳み財布 メンズ | bca.edu.gr

全商品オープニング価格特別価格】 nigo ルイヴィトン ポルトフォイユ

ルイヴィトン ポルトフォイユ ミュルティプル NIGO 折り財布 M81108-

超激安特価 新品未使用 超レア LOUIS VUITTON ルイ ヴィトン

ミュルティプルの値段と価格推移は?|38件の売買データから

ルイヴィトン【LOUIS VUITTON】ポルトフォイユ ミュルティプル - 折り財布

ルイヴィトン ポルトフォイユ・ミュルティプル グリーン 2つ折り財布-

Amazon | (ルイヴィトン)LOUIS VUITTON N60396 ポルトフォイユ

ルイヴィトン LOUIS VUITTON モノグラム ストライプ ポルトフォイユ

新品?正規品 限定品✨ルイヴィトン ポルトフォイユ・ミュルティプル

激レア】Louis Vuitton × Nigo LV MADEミュルティプル 数量限定 49.0

LOUIS VUITTON - LOUIS VUITTON ルイ・ヴィトン ポルトフォイユ

Amazon | (ルイヴィトン)LOUIS VUITTON N60396 ポルトフォイユ

ルイヴィトン ポルトフォイユ ミュルティプル NIGO 折り財布 M81108-

ルイヴィトン ×NIGO 折り財布-

ルイヴィトン×NIGO コラボ 長財布 メンズ M81008 ポルトフォイユ

ルイヴィトン ポルトフォイユ・ミュルティプル グリーン 2つ折り財布-

美品】LOUIS VUITTON ルイヴィトン モノグラム ストライプ NIGOコラボ

Amazon | (ルイヴィトン)LOUIS VUITTON N60396 ポルトフォイユ

全商品オープニング価格特別価格】 nigo ルイヴィトン ポルトフォイユ

名古屋】ルイヴィトン ポルトフォイユ ブラザ LVスクエアード M81008

驚きの価格が実現! LOUIS VUITTON - ディスカバリー・コンパクト

楽天市場】≪新品≫ルイヴィトン× NIGO LOUIS VUITTON × NIGO コラボ

名古屋】ルイヴィトン ポルトフォイユ ブラザ LVスクエアード M81008

楽天市場】≪新品≫ルイヴィトン× NIGO LOUIS VUITTON × NIGO コラボ

LOUIS VUITTON - ルイヴィトン × NIGO ポルトフォイユ・ミュルティプル

2023年最新】nigo louis vuitton 財布の人気アイテム - メルカリ

レア!ヴィトン☆ポルトフォイユ・ミュルティプル/折り財布/カード

ルイヴィトン ポルトフォイユ ミュルティプル カードケース財布 偽物

美品】LOUIS VUITTON ルイヴィトン モノグラム ストライプ NIGOコラボ

ヤフオク! -「nigo 財布」の落札相場・落札価格

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています