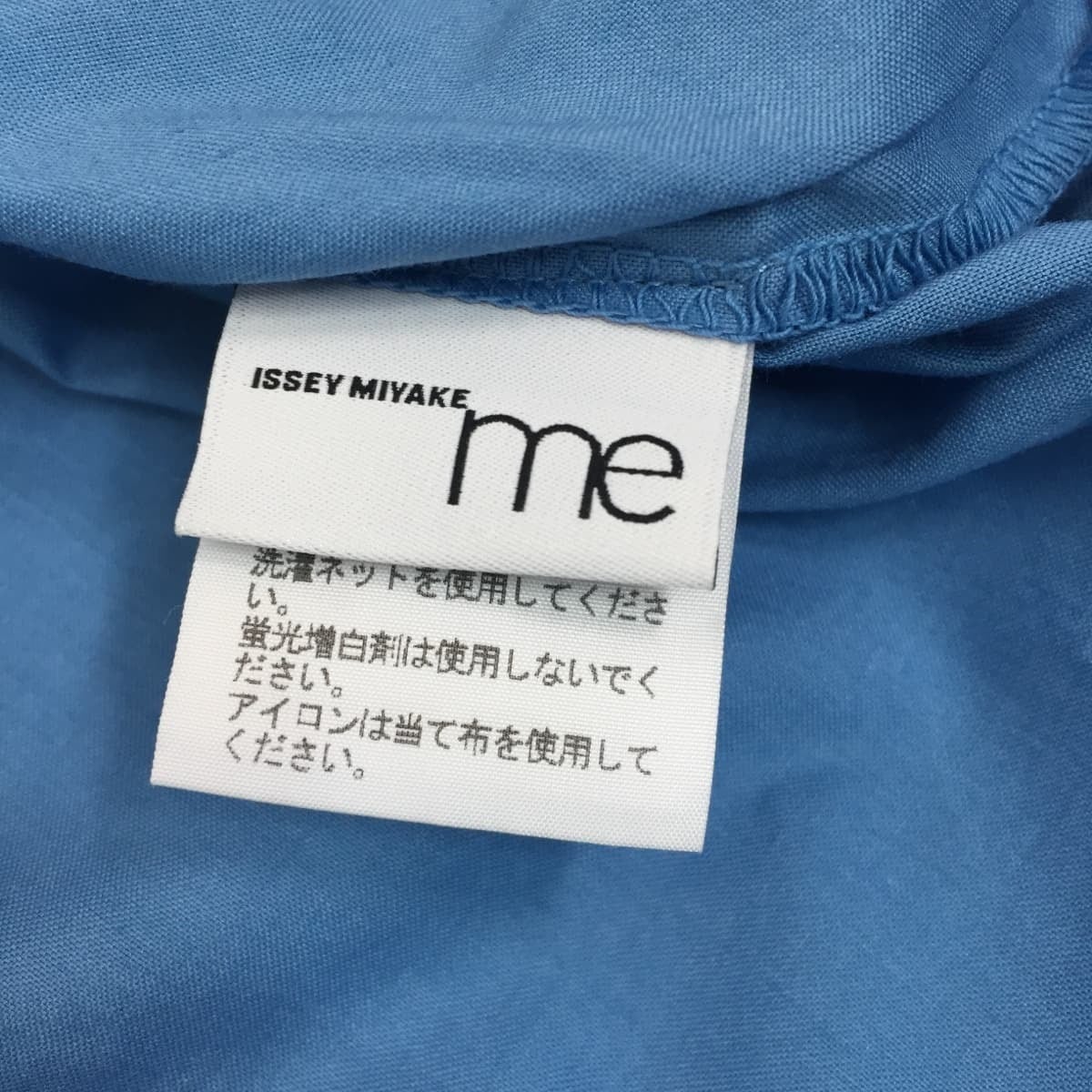

【issey miyake】シルクロングプリーツシャツ

(税込) 送料込み

商品の説明

issey miyake プリーツロングシャツ

シルクシャツ

Vネック長袖シャツ

希少なシルク

高級素材の絹50%が使われております。

ユニセックスで着用できます

原宿のセレクトショップで購入!

製品タグが薄くなってます。

前後ろ逆に着ても大丈夫なデザインになっております。

大きめなので、トレンドのオーバーサイズで着たい方におすすめ

2023012709900商品の情報

| カテゴリー | メンズ > トップス > Tシャツ/カットソー(七分/長袖) |

|---|---|

| 商品のサイズ | L |

| ブランド | イッセイミヤケ |

| 商品の状態 | 目立った傷や汚れなし |

ISSEY MIYAKE イッセイミヤケ IM12FJ943 プリーツ加工 ポケット付き サイドスリット ロング シャツ ブラウス パープル パープル系 2【中古】

美品 プリーツプリーズ イッセイミヤケ PLEATS PLEASE ブラウス タイ付き フリンジ プリーツ シャツ レディース 3(L相当) ブラック | フリマアプリ ラクマ

美品 プリーツプリーズ イッセイミヤケ PLEATS PLEASE ブラウス タイ付き フリンジ プリーツ シャツ レディース 3(L相当) ブラック

イッセイミヤケISSEY MIYAKE プリーツロングシャツジャケット ライト

イッセイミヤケ ロング シャツ(メンズ)の通販 15点 | ISSEY MIYAKEの

美品 プリーツプリーズ イッセイミヤケ PLEATS PLEASE ブラウス タイ付き フリンジ プリーツ シャツ レディース 3(L相当) ブラック

美品 プリーツプリーズ イッセイミヤケ PLEATS PLEASE ブラウス タイ付き フリンジ プリーツ シャツ レディース 3(L相当) ブラック

美品 プリーツプリーズ イッセイミヤケ PLEATS PLEASE ブラウス タイ付き フリンジ プリーツ シャツ レディース 3(L相当) ブラック

イッセイミヤケ メンISSEY MIYAKE MEN グラデーションプリントプリーツ

イッセイミヤケ プリーツ シャツ(メンズ)の通販 100点以上 | ISSEY

新品登場 Pleatsplease プリーツプリーズ ISSEYMIYAKE 美品トップス

イッセイミヤケ プリーツプリーズ ワンピース - ロングワンピース

イッセイミヤケ メンISSEY MIYAKE MEN グラデーションプリントプリーツ

イッセイミヤケme シャツコート プリーツプリーズ - ロングコート

お気にいる イッセイミヤケ 美品 ISSEY cg06om-rm04f04521 グレー M

イッセイミヤケ プリーツ シャツ(メンズ)の通販 100点以上 | ISSEY

オムプリッセ イッセイミヤケ(HOMME PLISSE ISSEY) メンズ 19年

イッセイミヤケ、変形プリーツバッグ-connectedremag.com

ISSEY MIYAKE リネン混 プリーツ セットアップ ロングスカート | mdh

ISSEY MIYAKE white Labelドレッシースカート-connectedremag.com

me ISSEY MIYAKE ミーイッセイミヤケ 20SS ITAJIME SHIRT 染色トップス

オムプリッセ イッセイ ミヤケHOMME PLISSE ISSEY MIYAKE プリーツT

イッセイミヤケ ISSEY MIYAKE シワプリーツ シャツワンピース ロング

PLEATS PLEASE ISSEY MIYAKE】90's slit long skirt(プリーツプリーズ

ISSEY MIYAKE me イッセイミヤケ プリーツ ワンピース 値引きする 49.0

オム プリッセ イッセイミヤケ 半袖シャツ プリーツロングプルオーバー

PLEATS PLEASE ISSEY MIYAKE】90's slit long skirt(プリーツプリーズ

イッセイミヤケ ISSEY MIYAKE シワプリーツ シャツワンピース ロング

me ISSEY MIYAKE ミーイッセイミヤケ 20SS ITAJIME SHIRT 染色トップス

TOUJOURS コットンビスコースシルクオーセンティックパターンランダム

中古】90s 1994 Vintage 美品 イッセイミヤケ ISSEY MIYAKE

イッセイミヤケ ミーISSEY MIYAKE me ツイストプリーツロングシャツ

ブラック】【Adoon plain】フロントプリーツシャツ(セットアップ着用可

イッセイミヤケ プリーツ シャツ(メンズ)の通販 100点以上 | ISSEY

イッセイミヤケPLEATS PLEASE】訳あり 黒Wジップロングカーディガン

新発売 イッセイミヤケ PLEASE PLEATS プリーツプリーズ セットアップ

PLEATS PLEASE ISSEY MIYAKE】90's slit long skirt(プリーツプリーズ

me ISSEY MIYAKE ミーイッセイミヤケ 20SS ITAJIME SHIRT 染色トップス

オムプリッセ イッセイミヤケ(HOMME PLISSE ISSEY) メンズ 19年

イッセイミヤケ ISSEY MIYAKE WHITE LABEL セットアップ 上下 カットソー ノースリーブ タイトスカート ミモレ ロング プリーツ 変形 絹混 シルク混 3 L 水色 ライトブルー /AN43 レディース

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています