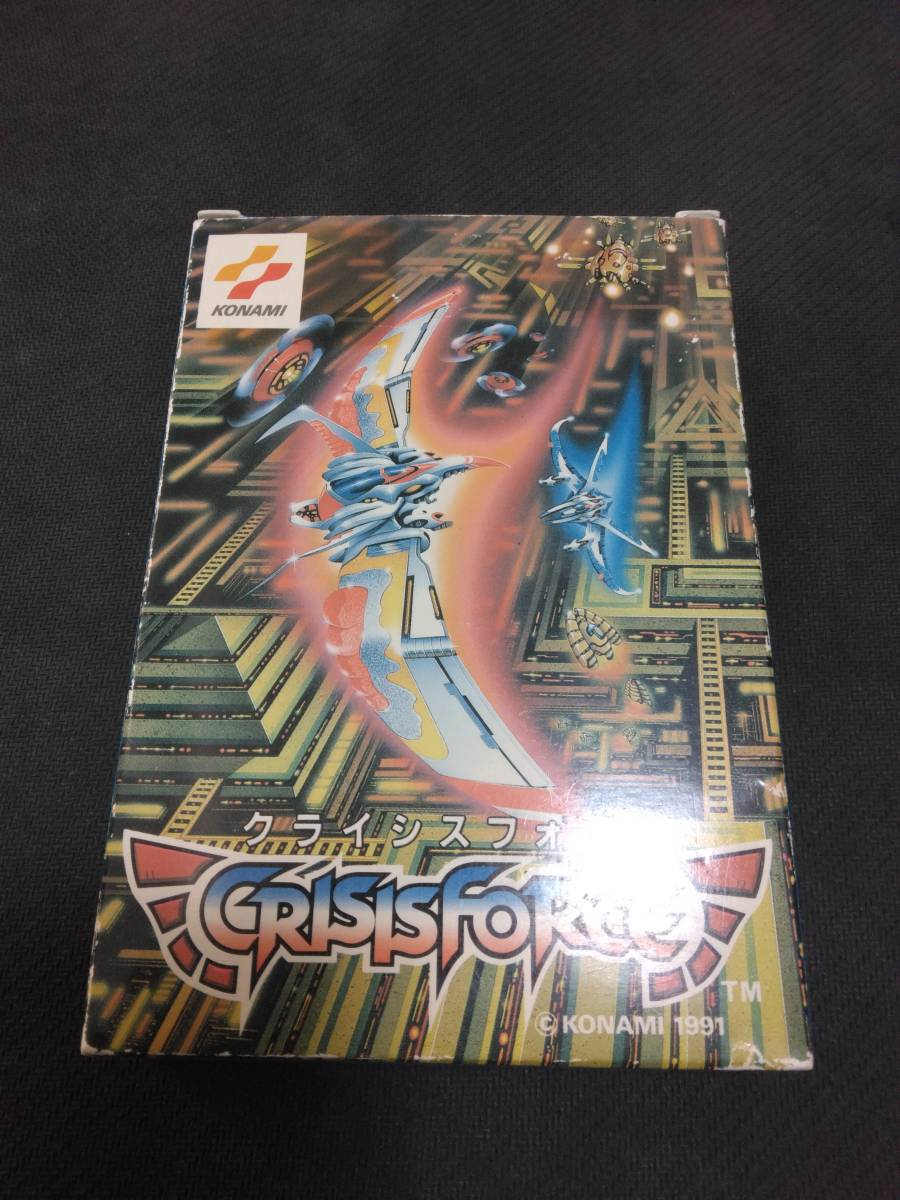

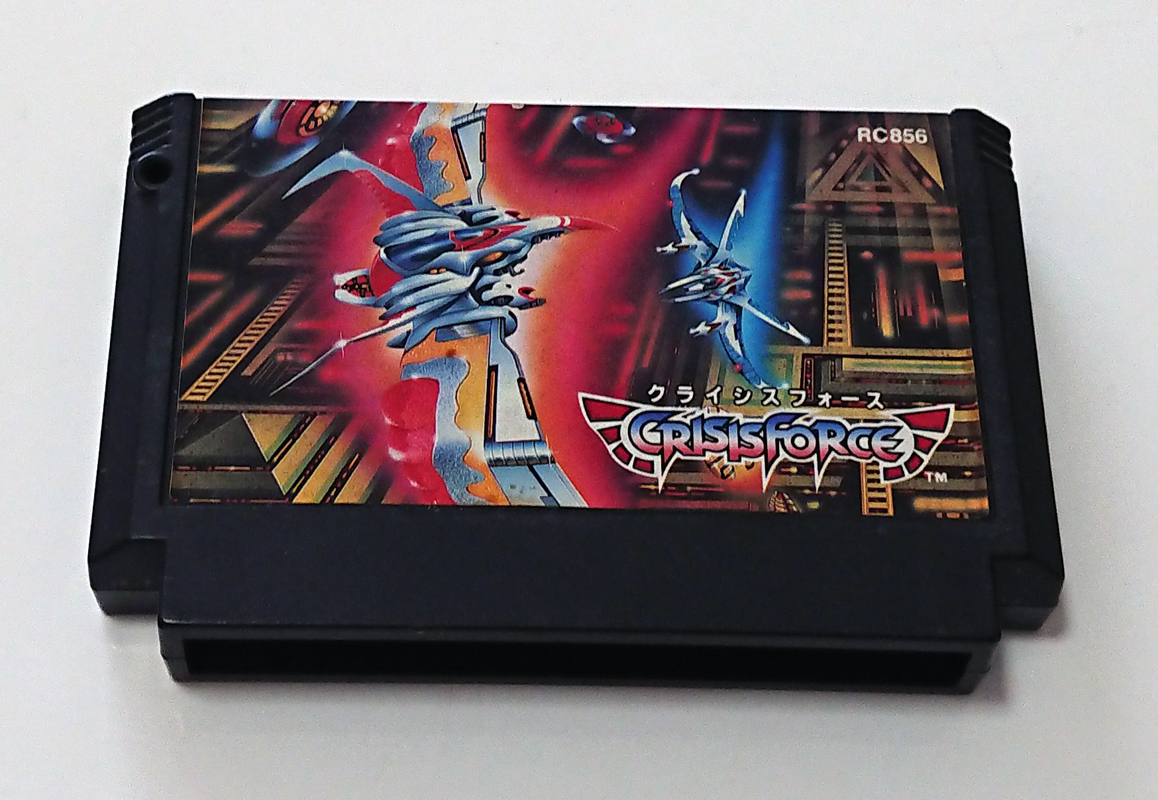

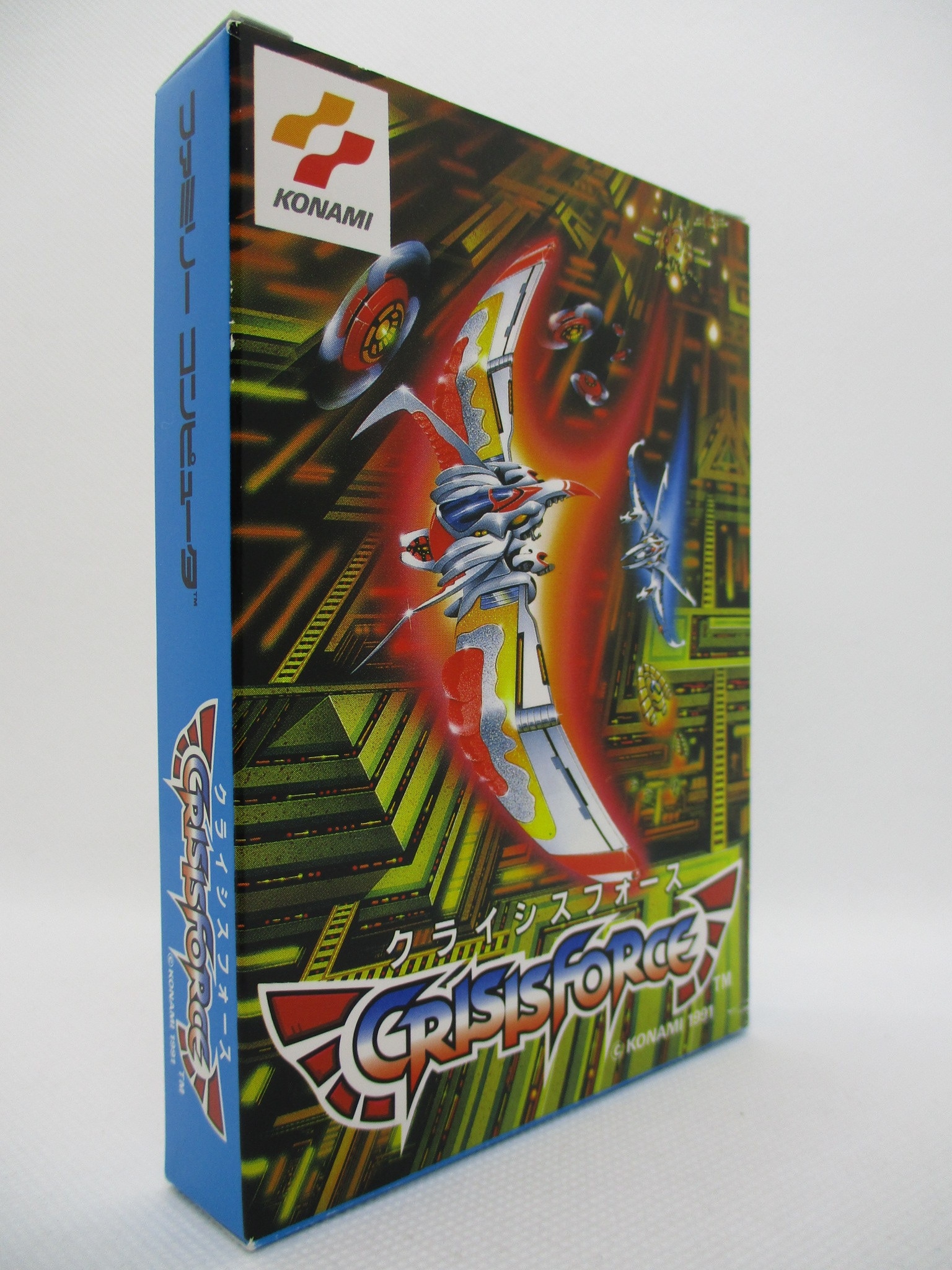

FC ファミコンソフト クライシスフォース ハガキ付き

(税込) 送料込み

商品の説明

FC ファミコンソフト

クライシスフォース ハガキ付き

写真のものが全てになります。

箱少し痛みありますので状態気にされる方はご遠慮ください。

ご検討よろしくお願い致します。商品の情報

| カテゴリー | 本・音楽・ゲーム > テレビゲーム > 家庭用ゲームソフト |

|---|---|

| 商品の状態 | 傷や汚れあり |

クライシスフォース 箱説明書付き ファミコン FC コナミ-

ファミコン クライシスフォース 箱、説明書、葉書、チラシ付き-

ベストセラー FC クライシスフォース シューティング - moonmana.com

FC クライシスフォース 国内正規品 - 家庭用ゲームソフト

2023年最新】クライシスフォースの人気アイテム - メルカリ

ファミコン コナミ クライシスフォース レアソフト 好きに 8820円引き

ファミコンソフト レア 【クライシスフォース】動作確認済

ファミコンソフト クライシスフォース-

ファミコン クライシスフォース 箱、説明書、葉書、チラシ付き-

お気に入り】 ☆ファミコン☆カセットのみ【クライシスフォース

カタログギフトも! 《同梱OK》箱・説明書・ハガキ付き!動作確認済

楽天市場】【中古】FC クライシスフォース*ファミコンソフト(箱説付

2023年最新】クライシスフォースの人気アイテム - メルカリ

ファミコン クライシスフォースの値段と価格推移は?|16件の売買

ファミコンソフト レア 【クライシスフォース】動作確認済

2023年最新】Yahoo!オークション -クライシスフォースの中古品・新品

ファミコンソフト クライシスフォース コナミ の商品詳細 | ヤフオク

楽天市場】【中古】FC クライシスフォース*ファミコンソフト(箱説付

FC】クライシスフォース : だんぼーるはうすinブログ

◇FC ファミリーコンピュータ ファミコン カセット 14点

クライシスフォース 箱説明書付き ファミコン FC コナミ-

注目 ☆中古品☆TAITO 中華大仙 ファミコンソフト タイトー

2023年最新】Yahoo!オークション -クライシスフォースの中古品・新品

2023年最新】クライシスフォースの人気アイテム - メルカリ

ファミコンソフト レア 【クライシスフォース】動作確認済

ファミコン クライシスフォースの値段と価格推移は?|16件の売買

ファミコン コナミ クライシスフォース レアソフト 好きに 8820円引き

中古】FC ファミコン クライシスフォース CRISIS FORCE 箱&説明書

◇FC ファミリーコンピュータ ファミコン カセット 14点

FC クライシスフォース / Crisis Force 1991 DEMO

クライシスフォース 箱説明書付き ファミコン FC コナミ-

中古】FC ファミコン クライシスフォース CRISIS FORCE 箱&説明書

最安値級価格 ファミコンソフト ガンナック FC ファミリーコンピュータ

クライシスフォース ファミコンソフト KONAMI - 家庭用ゲームソフト

楽天市場】【中古】FC クライシスフォース*ファミコンソフト(箱説付

クライシスフォース 箱説付 ファミコン ☆お求めやすく価格改定

◇FC ファミリーコンピュータ ファミコン カセット 14点

FC クライシスフォース | まんだらけ Mandarake

2023年最新】Yahoo!オークション -クライシスフォースの中古品・新品

2023年最新】クライシスフォースの人気アイテム - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています